Supplemental Security Income (SSI)

When people with disabilities, serious health challenges, or advanced age are limited at work, simply meeting basic daily needs can feel impossible. Individuals with few financial resources and no consistent income—especially those living alone or without family support—may feel like every day is an uphill battle. Federal initiatives like Supplemental Security Income (SSI) may be available to offer financial relief to qualifying individuals and help them overcome the toughest barriers to self-sufficiency.

What Is SSI?

Supplemental Security Income, or SSI, is a federal program that provides monthly payments to people with limited income and few resources. These payments are meant to help cover basic needs like food, clothing, and housing. It’s different from Social Security retirement or Social Security Disability Insurance (SSDI) benefits, and eligibility depends on financial need, not work history.

Reference: 1. Pew Research Center/ What the data says about Social Security. Published May 20, 2025.

Pear Research – How Many People Receive Social Security Benefits?

SSI is run by the Social Security Administration (SSA) and offers monthly financial benefits to adults and children who:

- Have little-to-no income

- Have little-to-no resources or assets

- Are aged >18 years or ≤65 years

- Are living with a disability or blindness that prevents them from working

With SSI, as well as additional government assistance programs like Medicaid, Supplemental Nutrition Assistance Program (SNAP), and the Housing Choice Voucher Program (HCVP), individuals and their dependents can cover essential living and health needs.

How Much Money Do SSI Payments Provide?

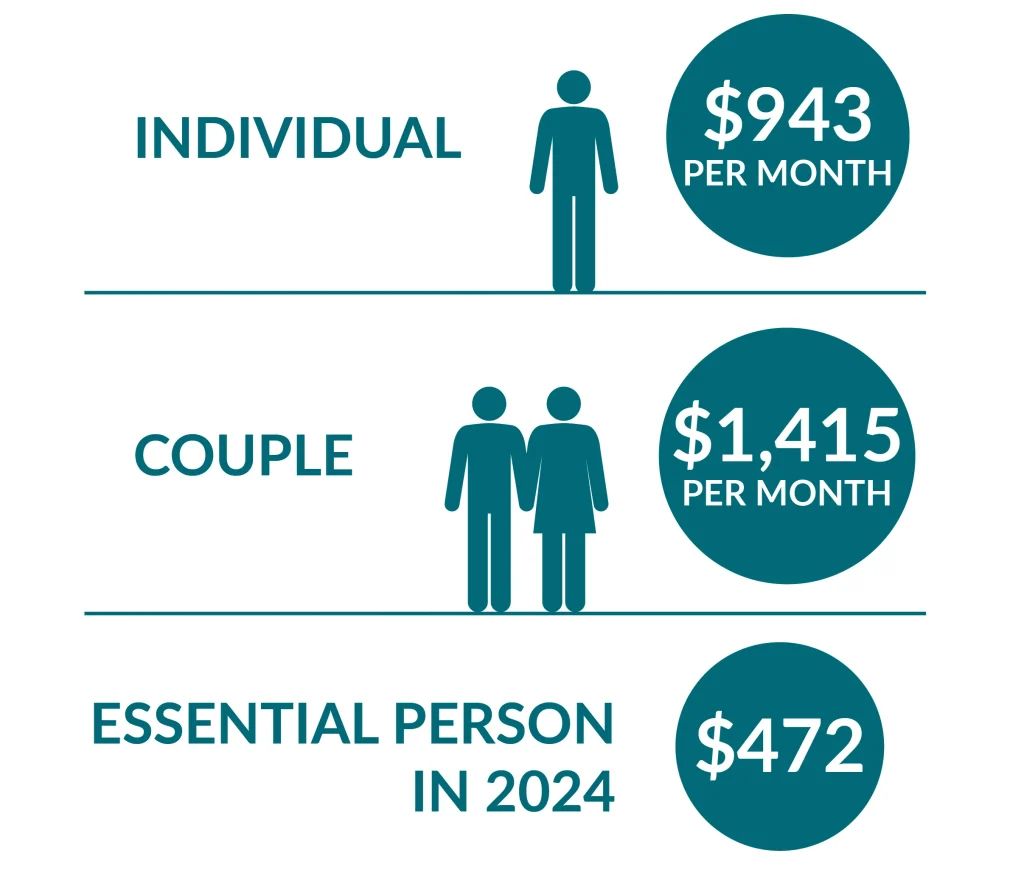

The federal base amount of SSI benefits changes each year and is based on the national Cost-of-Living Adjustment (COLA) to ensure payments maintain their purchasing power and offset the effects of inflation. For 2025, unrounded monthly payments are:

- $967 for individuals ($11,604.53 annually)

- $1,415 for couples ($16,980.36 annually)

Benefit amounts may be higher or lower depending on shared housing, additional state or federal benefits received, or other income.

Income Exceptions to SSI and Resource Limits

The Social Security Administration qualifies income as money received through wages, Social Security benefits, pensions, and income in the form of food and housing.

To qualify for SSI, the general monthly income limit (before taxes and deductions) is:

- $2,020 for individuals

- $2,985 for married couples who live and are applying together

- $3,993 for an individual who has a child with a disability

Note that these limits may be higher depending on the state a person lives in.

The SSA also considers Resources: money in checking or savings accounts, investments, or excess property. There are many important resources that do not count toward the resource limit, however, such as:

- The home an individual and their dependents live in

- One vehicle per household

- Personal items and household goods

- Property that can’t be used or sold (ex: property in probate or joint ownership)

SNAP benefits (food stamps) and certain types of government assistance do not count as Resources when determining eligibility.

How to Apply for SSI

The Social Security Administration suggests individuals first check their eligibility for SSI on their website. If eligible, applications for disability benefits can be submitted:

- Online, at SSA.gov

- By phone, by calling 1-800-772-1213 (appointment required)

- In person, by scheduling an appointment at a local Social Security office

Forms and documentation specifying income, disabilities and health limitations, and living situation are required, all of which can be found on the SSA website.

How Long Does It Take to Receive Benefits?

The SSI approval process generally takes between 6-8 months. Once approved, individuals typically receive their first payment on the first day of the month following approval. This date must fall at least 5 full calendar months from the date the disability began.

The approval process can take longer if additional medical evaluations are needed to prove eligibility. In some cases, payments may be backdated

In disability cases, the process can take longer if additional medical evaluations are needed. Once approved, benefits are usually paid the month after the decision is made. In cases of presumptive disability—disabilities that cause extreme financial hardship—the SSA may make payments during application review to individuals they believe will likely qualify for SSI.

Reporting Responsibilities While Receiving SSI Benefits

Anyone receiving SSI must report certain changes to the SSA that may impact eligibility, including:

- Changes in income or employment

- Changes in living arrangements

- Changes in immigration status

- Receipt of other benefits or lump sums (like an inheritance)

- Changes in resources

- Improvements in medical conditions

These changes, in the case of quality-of-life improvements, can result in benefit overpayment. A person receiving SSI benefits may have to pay back these benefits or may lose their benefits if reporting isn’t handled correctly or attempts at fraud at determined.

FAQs

What’s the difference between SSI and SSDI?

SSI eligibility is based on overall financial need and is for individuals with limited income and resources, though the impact of disabilities is taken into account. Qualifying individuals must also be aged >18 years or ≤65 years.

SSDI (Social Security Disability Insurance) eligibility is based on work history for individuals aged between 18 and ≤65 years. Individuals must be unable to work due to a documented disability and must have also worked and paid Social Security taxes for a specific time frame to qualify.

A person may receive both at the same time if eligible for each.

What documents are needed to apply for SSI?

Submitting all requested documents with an SSI application will help ensure that no setbacks or errors delay approval. The SSA requires the following:

- Proof of age (public or religious birth records before age 5)

Citizenship Record

- Citizenship or noncitizen status record, such as U.S. passport, current immigration or naturalization documents, an I-551 Permanent Resident Card, or an I-94 Arrival/Departure Record

Proof of Income and Resources

- Bank statements, deed or tax appraisal, life or disability insurance policies, burial and plot contracts, CDs, stocks, mutual funds, or bonds, and titles of registration

Proof of Living Arrangements

- Rent/land receipts or deeds or property tax bills

- Names, dates of birth, medical assistance cards, or Social Security numbers for all household members

- Proof of household cost of utilities and rent

Medical Services

- Contact information for all doctors, hospitals, and medical service providers and the dates an individual was treated

- Prescription and non-prescription medications taken

- Medical reports

Work History

- Job titles, business type, employer names, dates and hours per day worked, rates of pay in the 15 years before disability, and descriptions of job duties

The SSA offers a number of checklists, fact sheets, and worksheets on their website to ensure individuals collect the appropriate information to streamline application submission and review.

What counts as income?

The SSA has an extensive list of things it qualifies as income:

- Wages from a job in cash or other form

- Self-employed net earnings

- Department of Veterans Affairs (VA) benefits

- The value of food or shelter donated or paid by another individual

- Proceeds from life insurance policies

- Annuities, pensions, worker’s compensation, black lung benefits, Social Security benefits, and unemployment insurance benefits

- Railroad retirement and unemployment benefits

- Gifts and contributions

- Strike pay and union benefits

- Cash or property inheritances

- Rental income

- Alimony and support payments

Items that DO NOT count as income include:

- Medical care and services

- Social services

- Income tax refunds

- Money or selling, exchanging, or replacing personal items

- Loan proceeds

- Life or disability insurance payments on charge/credit accounts

- Bills paid by someone else for things beyond food and shelter

- Replacement of stolen or lost income

Qualifying resources include:

- Cash

- Savings and checking accounts

- Stocks and U.S. Savings Bonds

- Christmas club accounts

- Certificates of deposit (CDs)

It’s crucial to tell the SSA about all of these when applying. They not only affect eligibility and SSI payment amounts—in special circumstances, some things categorized as “income” may not be considered income.

What if someone is denied SSI?

Do SSI payments affect other benefits?

What conditions qualify for presumptive disability?

Generally, the SSA considers the following severe conditions to qualify for presumptive disability:

- Amputation of multiple limbs or a leg at the hip

- Total deafness or blindness

- Stroke >3 months prior with difficulty walking or using the hands or arms

- Down syndrome

- Amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s disease

- Symptomatic HIV infection or AIDS

- Severe intellectual disorder at age 7 or older

- Spinal cord injuries resulting in the inability to walk without assistance devices

- End-stage renal (kidney) disease

- Terminal illness with 6 months left to live or hospice services

- Cerebral palsy or muscular atrophy or dystrophy that severally impacts mobility, hand or arm use, or speech

- Bed confinement and immobility due to a longstanding condition

- Low birth weight depending on gestational age and weight

To qualify alongside presumptive disability, individuals and/or their dependents must meet all non-medical legal and financial SSI eligibility requirements. Presumptive disability often must be confirmed by a doctor, social worker, or school personnel alongside the SSA.